Global reimbursements

Global reimbursements

Global reimbursements with Expensify

Global reimbursements with Expensify

Pay your team back – no matter where they are. Expensify makes international reimbursements easier, smarter, and faster than ever.

Reimburse in 140+ currencies

Pay from 6 banking regions

Send funds to 190+ countries

Auto-match expenses

Realtime tracking

Sync with accounting

Reimbursing globally shouldn’t be a logistical nightmare. You shouldn’t need to juggle five tools, four currencies, and three weeks to pay someone back.

Expensify handles global reimbursements across multiple currencies in just a few clicks – with realtime tracking and automatic compliance along the way.

Send reimbursements worldwide – without the manual mess

With Expensify, you can reimburse employees in their local currency via direct deposit to 190+ countries. Just connect a business bank account in the US, Canada, UK, Europe, Australia, or Singapore – and let Expensify handle the rest.

No wires. No currency confusion. No extra tools. Just fast, secure, global payments that keep your team happy and your books clean.

Reimburse in local currencies

Pay employees back in nearly any currency – no matter where they live.

Global business bank accounts

Reimburse from business bank accounts in the US, Canada, UK, Europe, Australia, or Singapore.

Local bank payouts

Withdraw funds in 24 countries with bank accounts in USD, CAD, GBP, EUR, or AUD. And deposit funds to accounts in over 190 countries worldwide. That’s practically everywhere!

Realtime tracking

Monitor reimbursement status and delivery timing in your dashboard.

Accounting integrations

Sync global reimbursements with top platforms like Xero, NetSuite, Sage Intacct, QuickBooks, and more.

Automated compliance

Expensify handles VAT tracking, reporting visibility, and local policy enforcement across borders.

Secure transfers

Bank-grade security and built-in fraud controls ensure every global payment is protected.

No extra tools required

Reimburse in-app – no need for external vendors or separate platforms.

FAQs

-

Global reimbursements are payments made to employees or partners across different countries. Instead of wrestling with tricky currency conversions or international banking fees, companies use global reimbursement systems (like Expensify’s!) to handle these cross-border transactions smoothly.

-

The exact timeframe for reimbursement will vary depending on the currency of the sending and receiving accounts. Payments issued from GBP, EUR, or USD bank accounts are generally received within 1–4 business days.

-

The difference between approved and reimbursed within Expensify is that an approved report has been reviewed and accepted by your admin, while a reimbursed report means the funds have been triggered to be deposited into your bank. Not all approved reports need to be reimbursed, but all reimbursed reports need to be approved.

-

Yes! With a global accounting package, you can reimburse all around the world and export to top accounting platforms like Xero, Sage Intacct, NetSuite, QuickBooks, and more.

-

Employees can be reimbursed in nearly any currency. Expensify uses live exchange rates to handle conversions automatically. Your company’s reimbursement bank account must be located in the US, Canada, the UK, Europe, Australia, or Singapore.

-

Yes! Expensify supports reimbursements to employee bank accounts in over 190 countries, using secure local bank rails for fast delivery.

-

Absolutely. Expensify uses bank-grade encryption and has built-in fraud protection to ensure every reimbursement is safe and compliant.

With Expensify, global reimbursements feel local. Pay your team back in their currency, on time, and without the extra tools. It’s the smarter way to manage a global workforce.

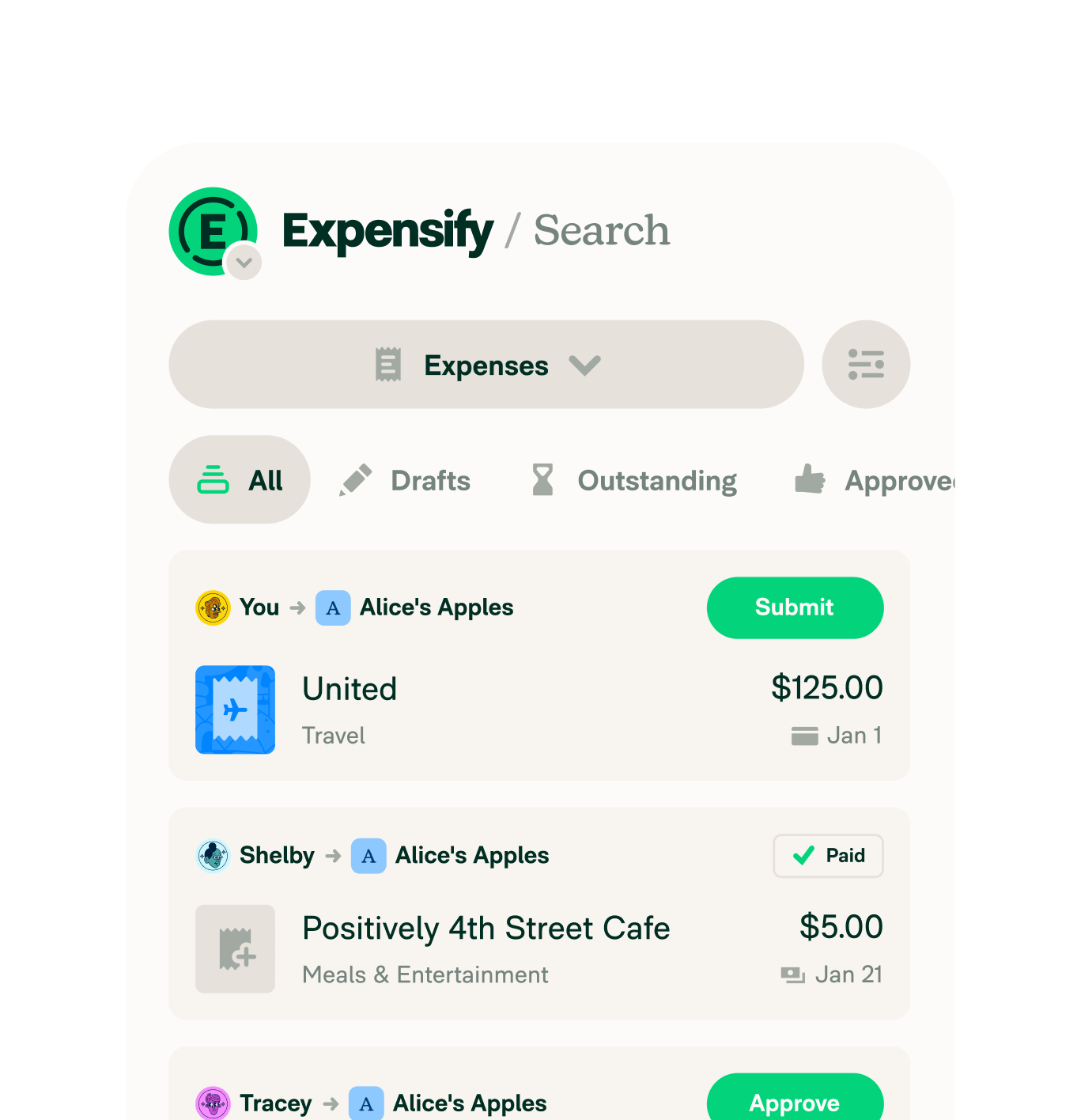

2-min demo

Try it for yourself

Learn the basics of Expensify in less than two minutes and see the magic for yourself.

Try demo